– January 3, 2013

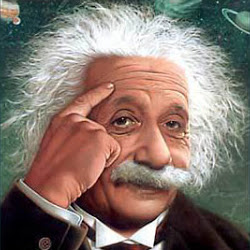

Albert Einstein must have been a claims manager!

Albert Einstein must have been a claims manager!

As we begin the New Year it is always a time to reflect and look forward to new beginnings. Recently an executive in my company sent along some words of wisdom from Albert Einstein. Einstein was an interesting character known not only for his scientific brilliance but also for his quick wit. He produced some wonderful quotes which I believe were directed to the claims industry.

OK maybe they weren’t written with the world of claims in mind, they are nonetheless applicable.

“Setting an example is not the main means of influencing others, it is the only means.”

Claims departments should be leading companies in how they run their business. Claims departments are the fruits of the product being sold and when an insured buys a policy it is claims that serves up the services paid for. One of the best ways to retain and grow new customers is by “setting an example” in claims. Ensuring customer service metrics are met and exceeded and developing new ways to assist the customer is not the “main means of influencing others, it’s the only means.”

“Any intelligent fool can make things bigger and more complex…it takes a touch of genius—and a lot of courage to move in the opposite direction.”

There is a trend for more systems, more technology and better information in claims departments. I am a big supporter and believe it’s about time the industry wakes up to the power more claims data can have in making departments more efficient and providing robust information to improve the business. Regardless, providing more complexity and bigger technology solutions is not the only answer. Be a “genius” and go smaller and less complex in building and implementing claims software. We have the technology it just needs to be used correctly.

“Not everything that can be counted counts and not everything that counts can be counted.”

This is one of the biggest claims dilemmas. We are being overwhelmed with data and that can be a good thing. Regardless, the fact that it can be measured doesn’t mean it is actually adding value to the process. Take a look at your metrics and really explore if what is being counted “counts.” On the other side, there are things in claims that unfortunately can’t be counted perfectly. Given how climate, legal issues and other external factors change rapidly, comparing claim metrics from period to period is sometimes a difficult exercise. Regardless, striving to “count” what “counts” is what the industry needs to continue to do.

“If you can’t explain it to a six-year old, you didn’t understand it yourself.”

Wouldn’t it be great if we could all work like this? Let’s be realistic, if you can’t explain your claim to management, opposing counsel, the claimant, in an easy simplified way then you probably don’t understand it yourself and will never get to the desired outcome. Like his quote on being a genius by making things smaller and less complex I say get to the point. It is still important to get all the facts and make sure all the “i’s” are dotted and the “t’s” are crossed, but do it in a way that will allow you to truly understand the claim and be able to explain it.

Linkedin

Linkedin Twitter

Twitter

It seems claims systems are being driven towards the upper management side of claims instead of its true functions, which is claims service and payment!

The six-year old part is one of the best tricks. I’ve been using it to deal with clients when discussing my work in home inspection, just to make sure that they don’t slap me back with a lawsuit later and eats up mye and o insurance. Thanks for the post.