Artificial intelligence isn’t new to insurance, but what’s changing is how deeply it’s being built into the way work gets done. McKinsey’s 2025 State of AI report notes that “more than three-quarters of respondents now say that their organizations use AI in at least one business function.” That’s real progress, but adoption alone doesn’t equal transformation.

From my experience leading and modernizing claims operations, I’ve seen how easy it is to confuse technology deployment with value creation. The real opportunity lies in how we redesign our workflows to make AI useful in everyday operations—and that’s where AI agents come in.

What AI Agents Actually Do

We’ve come a long way from chatbots that could only answer basic questions. AI agents are more like digital coworkers that can handle multi-step tasks across systems. They can read claim submissions, cross-check policy data, send alerts when something’s missing, and even recommend next steps to an adjuster.

In McKinsey’s research, AI agents are defined as “workflow operators” that “automate multi-step tasks, interpret context, reference company data, and make routing decisions.” In claims, that means they can process intake data, initiate payments for low-complexity losses, or flag anomalies for review—all without breaking stride.

When I helped lead automation initiatives in large-scale claims environments, the biggest wins weren’t about replacing people. They came from freeing adjusters to focus on what humans do best: investigating, empathizing, and resolving complex cases that can’t be scripted.

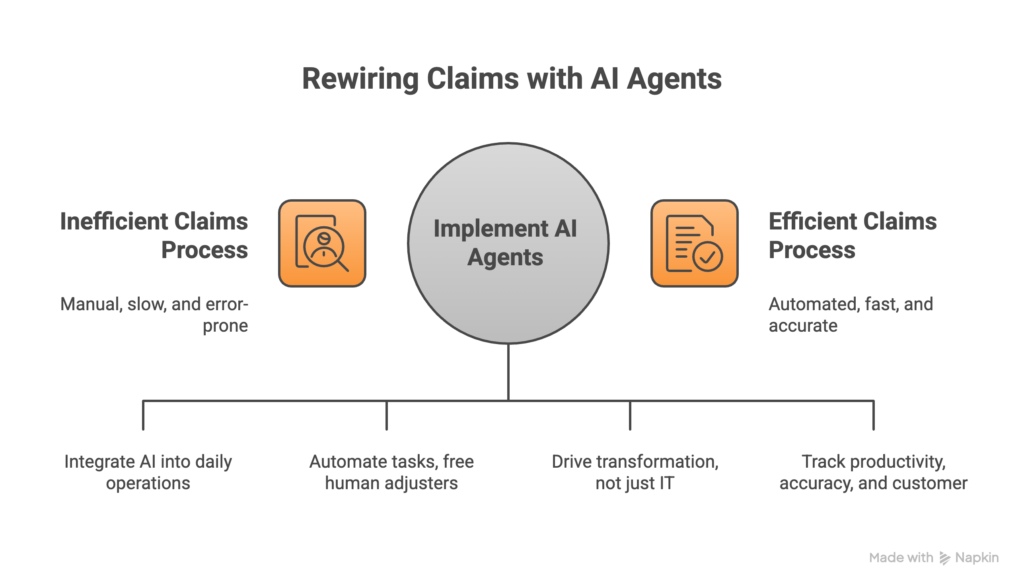

Rewiring Workflows, Not Just Automating Tasks

This point can’t be overstated. McKinsey found that “twenty-one percent of respondents reporting gen AI use by their organizations say their organizations have fundamentally redesigned at least some workflows.”

That statistic jumps out because redesign is exactly where most claims teams struggle. Too often, new tech is bolted onto old processes. The result? More clicks, not more efficiency.

I’ve seen it first-hand—systems meant to “streamline” end up slowing teams down when workflows aren’t rethought from the ground up. The key is to ask: what work truly adds value to the customer and the business, and what can we let the machine handle?

When insurers commit to this level of redesign, the gains can be dramatic. I saw a claims operation that rebuilt its intake process to allow customers to submit claims through a self-service portal integrated with predictive triage. The change cut setup times by 40 percent and reduced rework significantly. None of that would have been possible without rethinking the workflow itself.

Leadership and the Human Element

AI is powerful, but leadership still drives transformation. McKinsey’s report emphasizes that “the value of AI comes from rewiring how companies run,” and that rewiring depends on strong direction from the top.

Too often, claims modernization is seen as an IT project. In reality, it’s a leadership project. The best results I’ve seen happen when executives take ownership of operational outcomes, not just system launches. Governance, communication, and training make the difference between experimentation and lasting impact.

And while AI can execute with precision, it can’t show empathy. Claims handling will always have a human side—especially when customers are experiencing loss. AI agents can help process and predict, but people still need to connect and make judgment calls.

From Adoption to Advantage

AI’s future in insurance isn’t about novelty anymore. It’s about maturity. McKinsey’s research shows that while adoption is widespread, most organizations are still early in realizing real financial returns. The difference between those that do and those that don’t often comes down to mindset.

High-performing companies treat AI as part of their core strategy. They build feedback loops, train their teams, and track clear metrics. In my experience, claims departments that take the same approach—measuring productivity, accuracy, and customer outcomes—see the most sustainable results.

AI agents won’t eliminate the human adjuster, but they’ll change what that role looks like. Adjusters of the future will spend less time keying data and more time solving problems. That shift won’t just improve efficiency—it will make the work more meaningful.

Final Thoughts

The McKinsey report closes with a powerful reminder: “The value of AI comes from rewiring how companies run.” That’s the challenge and the opportunity for claims organizations today.

AI agents can execute tasks faster than we ever could, but it’s our job to design the systems, processes, and governance that make that power useful.

If your claims operation is exploring how to integrate AI or redesign workflows to capture real value, I’d love to help you think through it. You can reach me at mlanzkowsky@lanzko.com or learn more at lanzko.com.

Sources: